This year, it is planned to raise the price of up to fifteen thousand rubles for CTP insurance policies for some drivers.

This year, it is planned to raise the price of up to fifteen thousand rubles for CTP insurance policies for some drivers. Such information is reported by Rossiyskaya Gazeta.

Basically, insurance on the pocket will hit those "riders" who love to drive. The rest of the conscientious drivers will not feel the rise in price much.

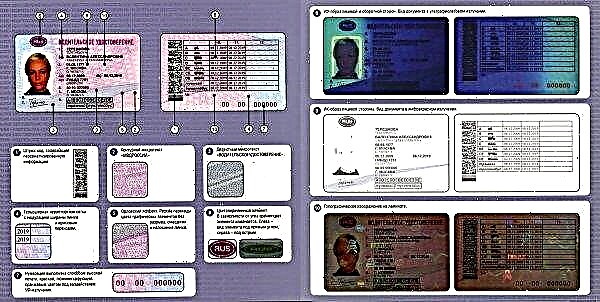

The newly introduced system will make it possible to monitor clients to calculate a special coefficient called "bonus-malus" according to the insurance history, which has been conducted for 2 years by each insurance company. All these insurers will be forced to submit the entire collected history of insurance customers in a single database. This will allow any "insurer" to find out over the past two years the history of the car owner - whether he was in an accident and how many times a year it happened. All insurance companies will have to constantly enter into the database new information on the issuance of OSAGO policies and all new cases of payment for insurance incidents within 15 working days.

For example: for driving last year without an accident, the car owner will receive a 5% discount on insurance this year. But if last year he was in a car accident, or rather was guilty of it, then this year the policy will be sold to him about 30% more expensive.

Experts made calculations for a Moscow driver, according to which the following turned out. If a driver has a driving experience of 3 years or more, as well as his age is more than 22 years, and he did not create a single accident over the past year, and his transport has more than 150 horsepower, then the CTP will cost him 3,485 rubles. Its bonus-malus will be 0.55, because more than nine years have passed since the inception of OSAGO. If this driver is guilty of an accident twice in the current year, then next new year he will have to pay the maximum amount for insurance that is a multiple of 15 523 rubles. Maybe this will somehow make drivers think about their driving of vehicles and accidents at least a little, but it will decrease.

It used to be much simpler. Created several accidents, well, that's okay, bought a policy from another insurance company. Now such actions will not work. Although it is possible to reset your driving history in a legal way. The law states that insurance companies keep an insurance history for each driver who has access to driving a vehicle, and it is reset when the driver has not been recorded in any insurance policy for one year. It is also possible to conclude an OSAGO agreement without limiting the circle of persons admitted to management.

There is one more news, not good for all drivers already. The Ministry of Finance wants to raise by as much as 25% tariffs for insurance policies of MTPL. If this happens, then, according to experts' calculations, the maximum policy may increase in price from 15 thousand rubles to 25.

Table of changes in the cost of OSAGO on the bonus-malus scale:

Prices are provided that the driver is from Moscow and the car has more than 150 hp.

| Class at the end of the annual line of insurance against the number of accidents | ||||

The meaning of bonus malus | MTPL price, rub | 0 accidents | 1 accident | 2 accidents |

| 2,45 | 15 523 | 2,30 | 2,45 | 2,45 |

| 2,30 | 14 573 | 1,55 | 2,45 | 2,45 |

| 1,55 | 9 821 | 1,40 | 2,45 | 2,45 |

| 1,40 | 8 870 | 1,00 | 1,55 | 2,45 |

| 1,00 | 6 336 | 0,95 | 1,55 | 2,45 |

| 0,95 | 6 019 | 0,90 | 1,40 | 1,55 |

| 0,90 | 5 702 | 0,85 | 1,00 | 1,55 |

| 0,85 | 5 386 | 0,80 | 0,95 | 1,40 |

| 0,80 | 5 069 | 0,75 | 0,95 | 1,40 |

| 0,75 | 4 752 | 0,70 | 0,90 | 1,40 |

| 0,70 | 4 435 | 0,65 | 0,90 | 1,40 |

| 0,65 | 4 118 | 0,60 | 0,85 | 1,00 |

| 0,60 | 3 802 | 0,55 | 0,85 | 1,00 |

| 0,55 | 3 485 | 0,50 | 0,85 | 1,00 |

| 0,50 | 3 168 | 0,50 | 0,80 | 1,00 |